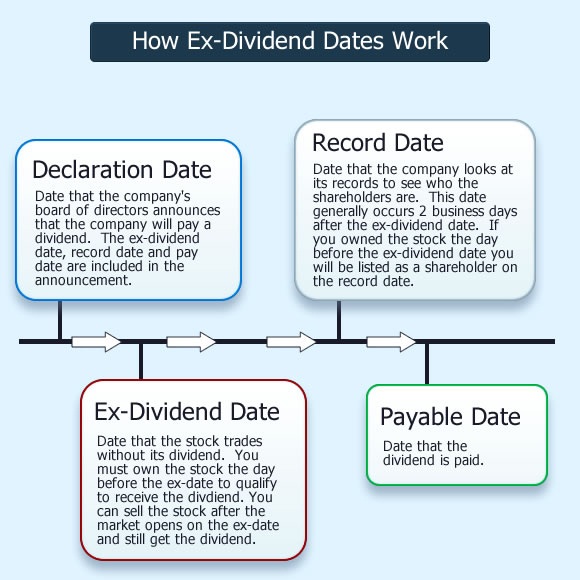

Dividend Ex Date Calendar – the ex-dividend date is normally set for two business days before the record date. (Remember, that’s business, not calendar, days.) If you purchase a stock on or after its ex-dividend date . Ex-dividend means a company’s dividend allocations have been specified. The ex-dividend date or “ex-date” is usually one business day before the record date. Investors who purchase a stock on its .

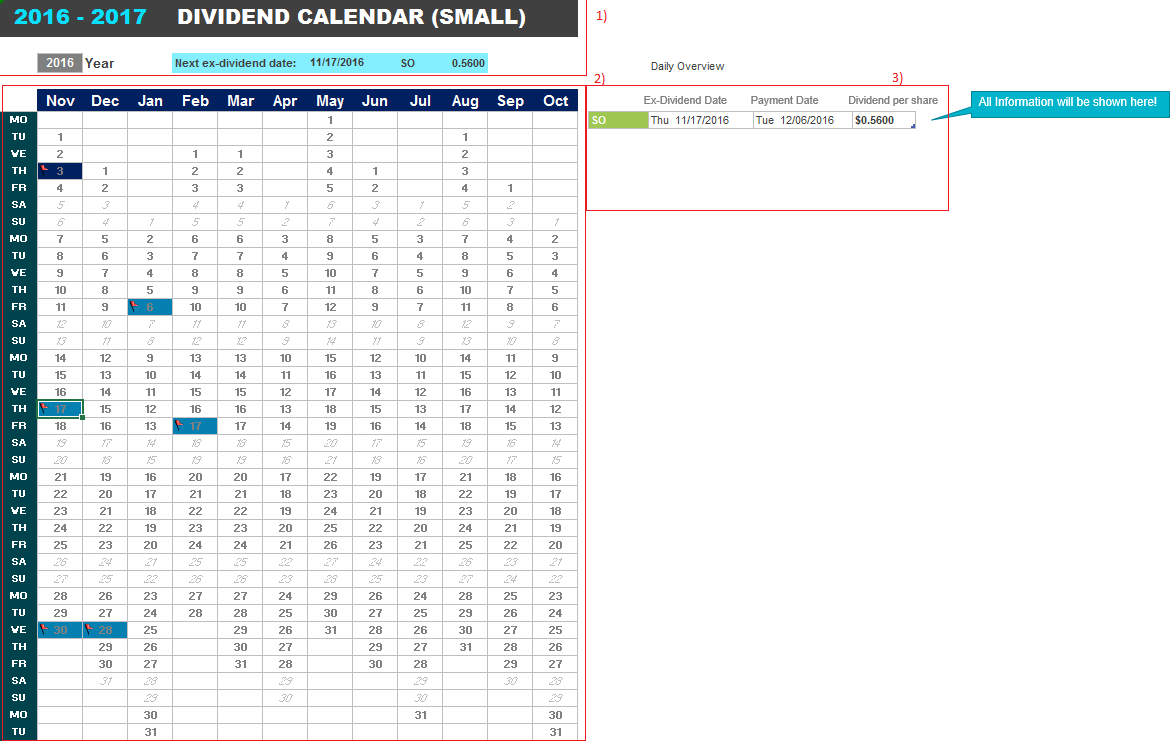

Dividend Ex Date Calendar

Source : dividendladder.com

Ex Dividend Date and 3 Dividend Calendar Strategies

Source : mystockmarketbasics.com

Ex Dividend Date vs. Date of Record: What’s the Difference?

Source : www.investopedia.com

Ex Dividend Date vs. Record Date: What’s the Difference? | Nasdaq

Source : www.nasdaq.com

Know Your Ex Dividend Dates Any Time With This Real Time Dividend

Source : seekingalpha.com

What Investors Need to Know About Ex Dividend Dates Dividend.com

Source : www.dividend.com

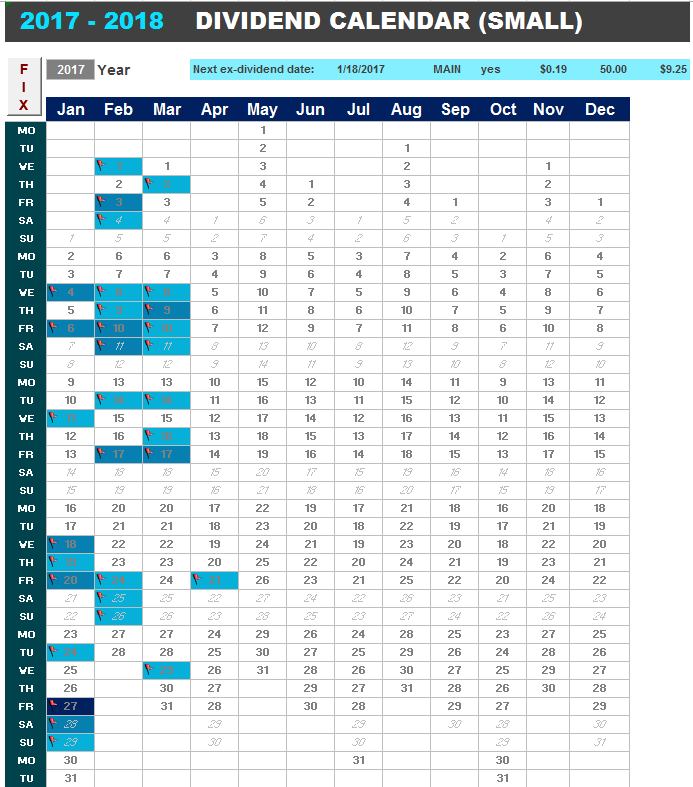

Know Your Ex Dividend Dates And Expected Payments Anytime With

Source : seekingalpha.com

Dividend dates Archives

Source : theeuropeanview.com

The Difference Between Record Date and Payable Date

Source : www.investopedia.com

Ex Dividend Date Calendar Jan 31 to Feb 04 With Hasbro And Wells Fargo

Source : theeuropeanview.com

Dividend Ex Date Calendar Ex Dividend Date Calendar Dividend Ladder: which is known as the payable or payment date. Dividend payment: The dividend is paid on the ex-dividend date, and the dividend amount is deducted from the company’s stock price at the opening . The ex-dividend date is the date on and after which new purchasers of a company’s stock will be ineligible for that stock’s upcoming dividend payment. Many profitable companies pay dividends to .

:max_bytes(150000):strip_icc()/dotdash_Final_Ex_Dividend_Date_vs_Date_of_Record_Whats_the_Difference_Oct_2020-01-6453b1e5c23146779ab4da7df074e8ab.jpg)

:max_bytes(150000):strip_icc()/DividendCaptureStrategy2-ed2bf3eddb4f4d56acf17a43a78ee358.png)